Term Plan Policy helps to secure your family

With the increasing health issues globally, no one can know what happen with them in the future. In which road accidents, health issues, and many more common death issues. Therefore, it’s essential to secure your family’s financial future in your absence.

With your savings, there are so many insurance plans with online facilities and tracking your policy online. These plans offer you to choose the best one for yourself.

The term plan is the best insurance plan. The term insurance plan is the less expensive or low premium part of life insurance that provides financial coverage to your family in case of death and any disability at the most affordable rates.

You can get a life cover or sum insured of term plan at a low premium rate. It is a very good insurance plan which helps your family thereafter you. It is a simple and affordable plan that provides you the high life coverage at a fixed rate for a specified tenure.

A premium of the term plan policy is calculated based on an individual’s age, health, and any existing health issues. The term plan covers you under some critical illness.

After the completion of the tenure of the policy than policyholder can renew the policy. But remember that when you opt for the renewal of your plan then the premium rate or term and conditions of the policy may differ before.

The premium of the term plan policy is better and cheaper as earlier as you buy it. For example, Sam is 28 years old and he is a non-smoker and a non-drunker as well he bought a term plan on worth ₹ 1238 per month and if he chooses the plan after crossing the age of 28 years old than the premium may increase from ₹ 1238 per month.

In also addition, with the current lifestyle and increasing health issues, it may become difficult to get or choose the term plan later.

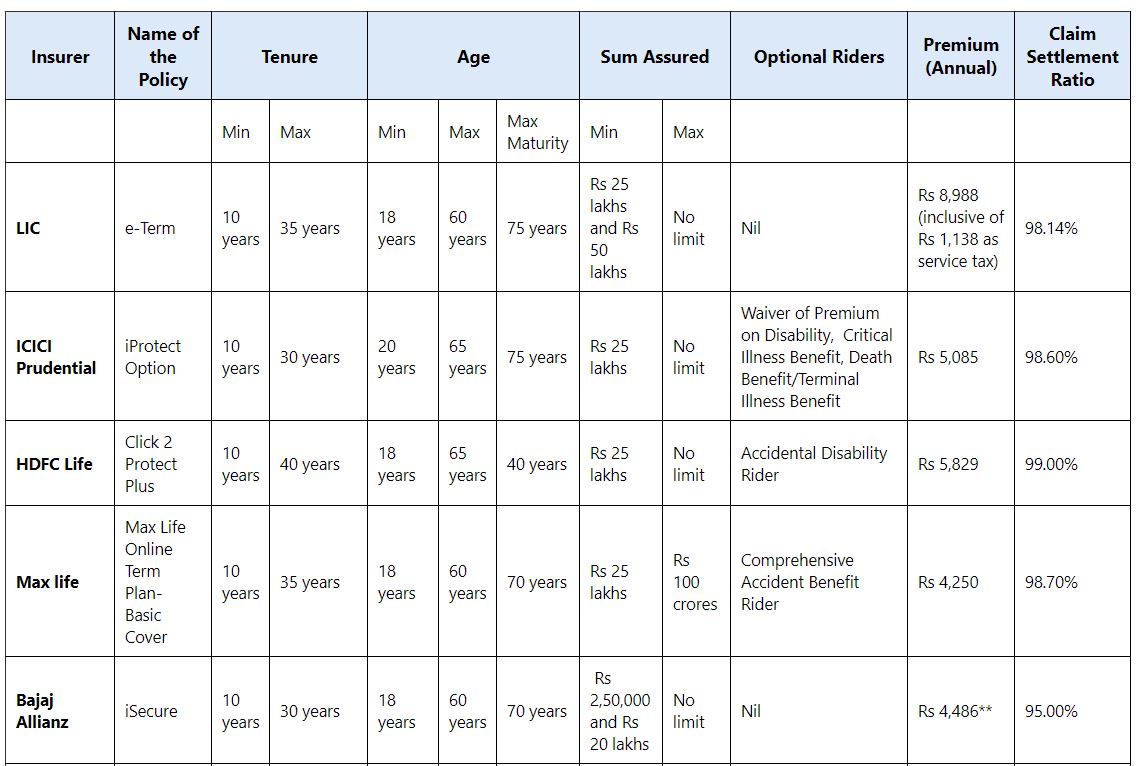

Best Term Life Insurance Plans in 2020 with their Claim Settlement Ratio:

Benefits of buying the term plan policies as given under:

- With the help of choosing a Term Insurance Plan, you can enjoy a Stress-free life.

- Tax exemption under section 80C of the Income Tax Act, 1961. The money received by the insurer’s family in case of unforeseen events can enjoy the tax benefit under Section 10(10D).

- You can easily pay the premium online or auto-debit from your savings account and your credit card.

- If you buy a term plan at an early age than you and your family can enjoy the benefit for a lifetime. The majority of the insurer will offer the coverage to 75 years.

- The term plan is the small investment that provides you the maximum gain as per the customized of the policy option which means the sum assured of the policy may be in lakhs or crores.

0 Comments